This year, say goodbye to tax season stress with the help of our daycare provider tax deduction checklist.

Filing your taxes doesn’t need to be a headache, yet tax time for many daycare providers means scrambling to determine income, expenses, and appropriate deductions. Why? Busy days providing for your small clients often mean important administrative tasks get pushed aside.

That’s why we’ve created a free tax deduction checklist to help simplify your tax season prep and provide a space for easy year-round expense tracking. Don’t miss a single deduction for your daycare business this year. Here’s how.

Table of Contents

Why Planning Ahead Reduces Tax Stress

If you feel like tax season is every season, you’re not alone. The pressure of filing taxes is an ongoing reality for many small business owners. This year, in particular, there is the added concern that recent IRS funding approved by the Senate means more agents—and more audits—for small businesses. While the effects of that funding remain to be seen, there are some practical ways you can reduce your tax stress this year.

Planning ahead is one of the easiest ways to limit the pressure you experience when filing your taxes. Going through the following daycare provider tax deduction checklist is the first step. While your daycare may have some unique or uncommon deductions, creating a list is the best way to identify those.

Unexpected costs and scenarios sneak up on us all the time. Planning ahead and determining your deductions in advance helps mitigate the energy and time it takes to track all those unexpected moments.

Common Deductions for Your Daycare

Before diving into the daycare provider tax deduction checklist, take a moment to consider how your daycare expenses are utilized. For example, every expense for a center-based daycare is 100% deductible. The same may not be true if you run your daycare out of your home.

Before diving into the daycare provider tax deduction checklist, take a moment to consider how your daycare expenses are utilized. For example, every expense for a center-based daycare is 100% deductible. The same may not be true if you run your daycare out of your home.

Home-based daycares have some unique deductions because many expenses are shared between the daycare and your personal life. Internet, cable, electricity, and mortgage payments are just a few examples of shared costs. You won’t deduct 100% of these expenses from your taxes, so tracking each one is incredibly important.

Some standard deductions that require good record-keeping include:

- Attendance for each child, including the specific days and hours

- Meal expenses and meal subsidy reimbursements

- Payments received for your daycare services

- All purchases related to the daycare (i.e., art supplies, games, cleaning supplies, etc.)

- Transportation costs

Not every item in the checklist will apply to your daycare. However, you can start every new fiscal year on the right foot by understanding key categories for daycare deductions.

Daycare Provider Tax Deduction Checklist

The following daycare provider tax deduction checklist is divided into expense categories. It’s impossible to deduct an expense you don’t track. This checklist is designed to help you track even those hidden expenses and get the most out of tax season for your business.

Category #1: Income

While income isn’t an expense, it is an important starting point when filing taxes. There are several different sources of income that should be tracked separately, including:

- Registration fees

- Tuition

- Late fees

- Subsidies from the Department of Social and Health Services

- Meal program

Any other income sources should also be added here, including fees for any additional programs or special projects offered at your daycare. The total from all your income sources will be the number you use to subtract the following deductions.

Category #2: Meal Program

Two variables will need to be tracked if you offer a meal program. One is the number of meals served, and the second is the amount spent on food for meals and snacks. Those daycare providers who participate in CACFP are likely already tracking meals. Regardless of whether or not you receive meal subsidies, avoiding an audit of your taxes requires meticulous records of every meal and snack you serve throughout the year.

The easiest way to keep track of your meal program is to list the meals offered throughout the day:

- Breakfast

- AM Snack

- Lunch

- PM Snack

- Dinner (if applicable)

Create a calendar that allows you to quickly count and jot down the numbers served for each meal on a daily basis. For expenses, track and save every receipt for food purchases throughout the year. If you are audited, and your meal program numbers don’t match, there is a chance your entire meal program deduction will be rejected. Keeping records protects you against such unfortunate scenarios.

Category #3: Business Expenses

Every business includes expenses that help keep the business running. Even if you didn’t spend copious amounts on advertising this year, other business costs will appear on any daycare provider tax deduction checklist. Here are the most common business expenses to keep track of:

- Payroll (be sure salaries are paid by check and not cash)

- Cell phones

- Office phones

- Office supplies

- Software

- Computers and printers

- Licensing fees

- Insurance

- Internet

- Cable

- Utilities

- Legal fees

- Dues (banking, association memberships, etc.)

- Gifts/promotions

Add any other expenses that come to mind as you work through the checklist. Be sure to include all software that is used solely for the daycare, such as accounting software, website hosting, and cloud-based storage, to name a few.

Category #4: Daycare Property Maintenance

Maintaining your daycare serves to keep your property both aesthetically pleasing and safe and is a critical deduction to include in your taxes. If your daycare is run from home, this category will need to be separated from other expenses that are 100% utilized for the daycare. We’ll touch on that later. In the meantime, here are some common expenses related to your daycare property:

- Security

- Landscaping (yard service)

- Maintenance

- Cleaning service

- Basic supplies (lightbulbs, filters, etc.)

- Safety items (babyproofing, etc.)

This category covers everything from repairing (or installing) the fence around your yard to having that pesky bee hive removed from your eaves. Remember that money spent to maintain and care for your daycare property should make it onto your list of deductibles.

Category #5: Goods and Supplies

Running a daycare requires far more daily supplies than the average small business. Your tiniest clients need everything from diapers to a comfy (and safe) space to take their daytime naps. While your daycare may focus on using supplies sent from each kiddo’s home, there are still plenty of expenses that provide for the comfort of your clientele. Here are the most common to get you started:

- Bedding

- Diapers and diapering products

- Cleaning supplies

- Bottled water

- First aid

- Furniture

- Kitchen supplies/small appliances

- Paper products

- Laundry supplies (and number of loads)

- Party supplies

Furniture may seem out of place in this category, but remember that everything from art tables to bookshelves, chairs, and couches serve to keep your daycare functioning.

Category #6: Education

Your daycare provider tax deduction checklist is certainly not complete without the expenses that go into the education and support of your little ones. Every toy that is purchased for exclusive daycare should be deducted from your taxes. This also applies to daycare supplies purchased for arts and crafts, new books or subscription reading programs, and the decorations you use to make each room in your daycare welcoming and educational. Every time you make a trip to the art supply store, remind yourself to keep that receipt! The following are some other common deductions that fit into the education category:

- Games

- Art supplies

- Books and magazines

- Curriculum

- Computer games

- Decorations

- Animal supplies (excluding cat or dog food)

- Photo and film (or photo printing supplies)

- Toys

- Videos (or streaming services/subscriptions)

- Play yard equipment

- Computers and TVs (non-office use)

There are so many details that fill your day when running a daycare. It is easy to forget that the special newsletter you send home to parents requires photos (a digital camera), software (to create and design the newsletter), and paper and ink (to print it). These items fit your deduction categories and are all items worth tracking.

Category #7: Transportation

If you use your car for daycare use (or have a car specifically for the business), then keeping track of your transportation costs is key. There are two ways to track your auto expenses for the IRS. The simpler method is most common if you occasionally use your personal car for daycare use. This method requires you to track the car’s mileage for the entire year (January through December) and the total miles driven for business use. Your deduction is based on the difference in mileage. For this more straightforward method, you must track the following throughout the year:

- Total miles driven for the year

- Total miles driven for the daycare during the year

- Amount of interest paid on the car if financed

If you use your car almost exclusively for daycare purposes, the second method covers your expenses in more detail.

- Total miles driven for the year

- Total miles driven for the daycare during the year

- Amount of interest paid on the car if financed

- Cost or value of the vehicle when you first began using it for the daycare

- Expenses for:

- Gas

- Oil

- Licensing

- Insurance

- Repairs

For either auto deduction method, you must track your expenses as they happen. Mileage should be tracked daily (using a phone app or spreadsheet), so you can easily prove your expenses to the IRS and receive the full deduction possible for your vehicle.

Category #8: Shared/Home Business Expenses

Running a home business comes with a slightly different set of rules for deductions. If your daycare is run from home, then your daycare provider tax deduction checklist isn’t complete without this category.

Home business expenses are often shared between personal use and daycare use. Some items in the above categories may fall into this bucket. For example, the TV you use for movie time during daycare hours is the same TV you use to watch the evening news after work. This category is to help you distinguish how your goods and furniture are shared between the home and the daycare. This includes the following:

- Large furniture

- Appliances

- Computers

- Supplies (art, cleaning, kitchen, paper supplies, household goods)

The next step in this category is listing your home expenses. Unlike center-based daycares, your mortgage or rent payment covers the cost of your daycare facility and your living space. When filing taxes, you’ll deduct a percentage of your expenses based on how many hours your home was used as a daycare. Here’s what to keep track of throughout the year:

Hours

- Number of days your daycare was open

- Total hours of operation for the year

Space

- Total square footage of your home

- Total square footage of rooms used regularly for daycare (exclude rooms such as your bedroom or other rooms off-limits during daycare hours)

- Mortgage payments (and interest paid)

- Real estate taxes

Utilities

- Insurance

- Electricity/gas

- Water

- Internet/Cable

- Garbage

- Yard maintenance

- Cleaning service

- Repairs/maintenance

Working with a tax professional for home business expenses can reduce some of the stress that comes with filing your taxes. Regardless of how you file, tracking every expense is key!

Best Practices for Preventing Audits

No single business owner wants to experience a tax audit. The best way to prevent an audit is to track and prepare as if you will be audited. That is where the daycare provider tax deduction checklist comes in handy. Audits are often triggered by inaccuracies or expenses that fall outside the realm of what the IRS considers “normal.” Tracking every expense, while tedious in the short term, will pay off in the long run. Not only that, but should you get audited, you’ll have the data to back up your deduction claims.

No single business owner wants to experience a tax audit. The best way to prevent an audit is to track and prepare as if you will be audited. That is where the daycare provider tax deduction checklist comes in handy. Audits are often triggered by inaccuracies or expenses that fall outside the realm of what the IRS considers “normal.” Tracking every expense, while tedious in the short term, will pay off in the long run. Not only that, but should you get audited, you’ll have the data to back up your deduction claims.

Preventing an audit isn’t always possible, so working through the daycare provider tax deduction checklist is an easy way to reduce the stress of tax season. Just like you teach your little ones to have their “ducks in a row,” following the checklist is a great way to keep your tax deduction ducks in a row. You and your tax professional can breathe easy knowing you’ve worked hard to get the most deductions this tax year.

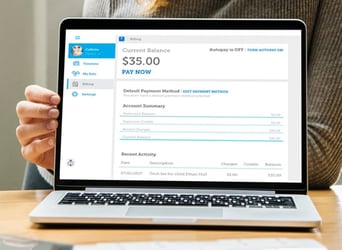

How Software Can Help Prevent Audits and Simplify the Tax Process

Having the right tools to keep track of key records and generate vital reports makes your accounting tasks a lot easier. With Smartcare, a child care management software from Vanco, managing records, building reports and generating tax statements is simple.

Smartcare even automatically generates tax statements for your families. Easily download or send out tax statements to all your families directly from the center app with just a few clicks. On top of that, your families get instant access through their parent app to make it even easier for them to get the paperwork they need.

Take just a few minutes to see how Smartcare can save you and your staff countless hours on admin tasks like tax statements, reporting, billing, parent communications and more!

Watch our free, on-demand demo.