A child care tax receipt is one of the most important documents for any child care facility. These receipts are helpful for both the child care center and for parents or guardians who may need to claim the money they pay your daycare center on their tax return for the year. That’s why it’s vital that staff members know how to properly write a receipt and what information needs to be included in order for parents and guardians to have what they need when they file their tax return. Below, you’ll find helpful tips and information that will help you and your staff create complete, accurate child care tax receipts.

Table of Contents

- What's Needed on a Child Care Receipt for Tax Purposes?

- How to Write a Tax Receipt for Child Care

- Free Daycare Tax Statement Templates

What's Needed on a Child Care Receipt for Tax Purposes?

As a daycare operator, providing child care tax receipts and other financial information is an important service you provide to families, in addition to your normal daily interactions with them.

In 2022, American families are spending over $10,000 on child care costs each year. Because childcare is such a necessary service for working parents in the U.S., they must pay these costs or risk not having adequate care for their children while they're at work. But new tax laws and allowances make it possible for parents to get a portion of this money back on their taxes.

Under the Child and Dependent Care Credit, parents can claim up to 35% of their child care expenses on their tax returns, up to $3,000 for one person or $6,000 for two or more people. This percentage can vary based on several factors including tax bracket and overall income. It’s important to note that this is a credit and not a tax deduction.

President Biden's Child Care Tax Credit can help lift a huge burden off working parents. The American Rescue Plan Act takes tax savings a step further, but note that this Act only applies to the 2021 fiscal year for 2022 taxes.

The Act allows working parents with children in child care to write off up to 50% of their child care tax expenses depending on their income level. Under the American Rescue Plan Act, instead of receiving a $3,000 credit for one individual, parents can now get up to $8,000. For two or more dependents, this number skyrockets to $16,000.

If any parents of children at your daycare center also receive any government subsidies like grants or financial aid for child care, you need to account for this on your child care receipts as well. And daycare providers must account for these subsidies and child care aid on their own daycare tax returns because the subsidies are not automatically taxed.

With so much riding on child care tax filling, having a child care tax receipt can make a big difference in a smooth filing process. It can also offer a better experience for both parents and daycare centers during hectic tax times. This guide explains what daycare centers need to do to accommodate this process and how to write a tax receipt for child care.

What Daycare Centers Are Required to Provide to Parents

Daycare centers are required to provide parents with an annual daycare tax statement. This statement shows the total amount parents spent on child care costs during the past year. This statement should cover January 1st through December 31st of the previous year.

The last day of February is often the final day that daycare centers should have this information available. You need to give parents enough time to prepare for their April 15th filing deadline.

Daycare and childcare centers need to include certain information on each daycare tax statement. This information includes:

- The name of the person the receipt is for

- The name of the child receiving daycare services

- The amount received for childcare services

- The dates covering the childcare services

- Your name or your daycare business's name

- Your daycare center's address

- Your Employer Identification Number (EIN)

- Your authorized signature

- The date the receipt was signed and verified

Filling out a child care tax receipt may not be a requirement in many places, but it’s still a good business practice. It keeps your daycare business accountable and comes in handy for reconciling business taxes if your daycare is ever audited by the IRS. Parents will also trust your center more if you are amenable to their needs for this information.

Having two copies is ideal so you can keep one for your own records. You should also have parents sign one of these daycare tax statements that verify they received the information and that the statement is correct.

If any disparities in the statement arise, it's important that you give yourself and parents time to figure out the real issue with the figures provided. Proper recordkeeping is essential for both parties.

What Daycare Centers Aren't Required to Provide to Parents

Parents may ask you to provide your personal Social Security number (SSN) to them for tax purposes. Under no circumstances should you do this.

Supplying your personal SSN puts you at risk of identity theft or fraud. Your EIN is sufficient for tax filing purposes.

Parents may ask you to supply them with a W-10 Dependent Care Providers Identification and Certification form from the IRS. However, this is not a requirement for the daycare. It's the responsibility of the parent to provide this form to the daycare to fill out.

If a parent provides the W-10 IRS form to the daycare, the daycare must fill it out or face a penalty.

How to Write a Tax Receipt for Child Care

When writing a child care tax receipt, you should include certain elements in its format. You need to have the most basic information, like the date you provided the tax receipt. You should also list your daycare provider information. This includes your name or your daycare's name, along with your address, phone number and email address.

Write the name of the child receiving care at your center. Under that, fill in the parent's information. Put their name, address and phone number.

State the name of the provider and the service provided is, that is, child care. Then, write the agreed-on form of payment received for these services (like cash, credit card or check) and when these payments are due (monthly, weekly, bi-weekly, etc.)

Track the number of hours the daycare service was provided in a given time-frame. List the base per-hour rate on the form. Calculate the total number of hours with the base hourly rate to get the total cost for that period.

If your daycare services have any extra fees associated with them, include these in the final cost as well. This could be anything from late pickup fees or late payments. You need to account for every aspect that parents are charged for in the care of their children at your center.

Sign your name at the bottom of the form and have parents also sign their names to verify the correct information. You can use a program like Excel to fill in these reports digitally or you can use a daycare tax statement template to print out blank copies and fill them in manually.

Sending the Completed Form to Parents

There are a few ways you can ensure parents receive the child care tax receipt. You can keep them at your center to give to parents on the last day of daycare before year-end. Notify parents what day this will be and post it on your daycare's door so they know.

If you're worried about parents losing their daycare tax statements in the shuffle of the last day of daycare, mail physical copies to their home addresses. Send instructions that tell them to verify the data is correct. Ask them to sign and send a copy back to you for your records.

You can also email them a copy to review and print. Make certain that you tell them to verify that the information is correct and sign a copy and send it back to you.

If a parent and child left your center mid-year, you should still send them a copy of their daycare tax receipt for the portion of the year they were enrolled at your center, as long as they left on good terms. If they left owing you money, you should send a letter to their home address on file stating that you will only offer them a tax receipt once the outstanding balance is paid in full.

Other Instructions to Consider

Inform parents that it's their responsibility to furnish the W-10 form to your daycare to obtain any child care tax filing information and not the center's responsibility.

Some centers may fill out weekly or monthly daycare tax receipts for parents as a way to keep track of expenses and payments or they may fill them out on request. This will depend on your center's unique policies.

Using a Childcare Management System

If you use a dedicated childcare management system, it can track parent payments for you. You can also generate automatic daycare tax statements and reports. Your child care management system can send these receipts to parents automatically through email.

Childcare management systems help you manage payments through an easily accessible portal. Each child's profile contains the proper payment information. You can view all of the payments made and view a full daycare invoice of the total received for each child in a given calendar year.

Daycare Tax Statement Templates

So what's needed on a child care receipt for tax purposes? There are several key pieces of information and several ways you can format your child care tax receipt or daycare tax statement. These don't have to be long and involved forms. As long as you give parents the necessary payment information they need for tax filing, you should be fine.

Here are three different examples of daycare tax statement templates you can use. One template is a receipt-style format while the other two are tax statement formats. You can copy and paste the text into your own document or use the free templates

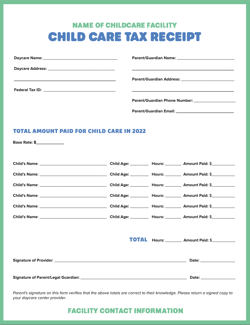

Daycare Tax Receipt Template

This is a basic daycare tax receipt template. It lists and tracks payments made to your daycare center in a calendar year. Both the provider and the parent should sign and date the form.

Daycare Tax Receipt Text

[Daycare Name] Child Care Tax Receipt

[Daycare Address]

[Daycare Address]

Federal Tax ID:

[Parent/Guardian Name]:

[Parent/Guardian Address]:

[Parent/Guardian Phone Number]:

[Parent/Guardian Email]:

Total Amount Paid for Child Care in 2022

Base Rate per Hour: $ [Enter Amount]

Child's Name: _________________ Hours_____ Amount Paid: $________

Child's Name: _________________ Hours_____ Amount Paid: $________

Child's Name: _________________ Hours_____ Amount Paid: $________

Child's Name: _________________ Hours_____ Amount Paid: $________

Child's Name: _________________ Hours_____ Amount Paid: $________

Child's Name: _________________ Hours_____ Amount Paid: $________

Total Hours_____ Total Amount Paid: $_______

[Signature of Provider]: __________________________ Date: __________

[Signature of Parent/Legal Guardian]: _______________________

Date: _________

Parent's signature on this form verifies that the above totals are correct to their knowledge. Please return a signed copy to your daycare center provider.

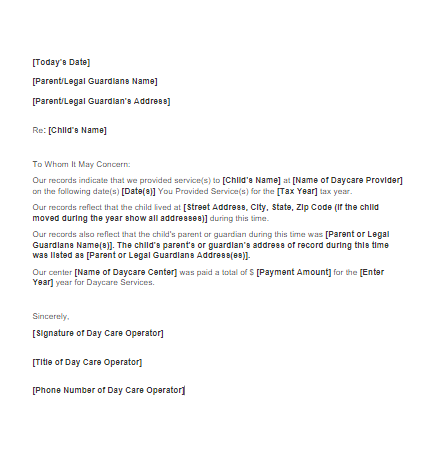

Daycare Tax Statement Template #1

Text for Template

This child care tax receipt has a more formal tone, rather than just listing daycare payments received. Use this format to provide information to parents for verification of information to the IRS. This form letter is filled out and signed by the daycare provider operator only.

[Insert Screenshot]

[Today's Date]

[Parent/Legal Guardians Name]

[Parent/Legal Guardian's Address]

Re: [Child's Name]

To Whom It May Concern:

Our records indicate that we provided service(s) to [Child's Name] at [Name of Daycare Provider] on the following date(s) [Date(s) You Provided Service(s) for the [Tax Year] tax year.

Our records reflect that the child lived at [Street Address, City, State, Zip Code (if the child moved during the year show all addresses)] during this time.

Our records also reflect that the child's parent or guardian during this time was [Parent or Legal Guardians Name(s)]. The child's parent's or guardian's address of record during this time was listed as [Parent or Legal Guardians Address(es)].

Our center [Name of Daycare Center] was paid a total of $ [Payment Amount] for the [Enter Year] year for Daycare Services.

Sincerely,

[Signature of Day Care Operator]

[Title of Day Care Operator]

[Phone Number of Day Care Operator]

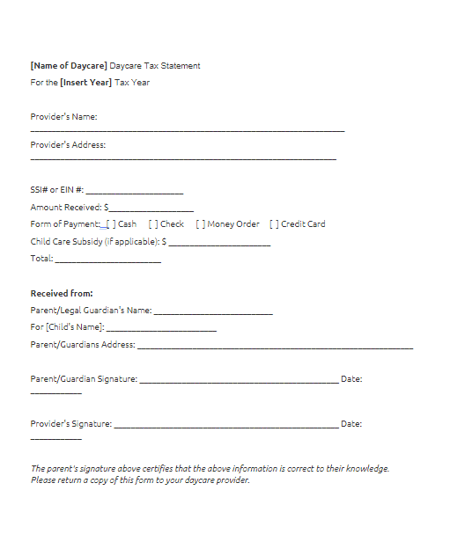

Daycare Tax Statement Template #2

This daycare tax statement is a straightforward approach to creating a child care tax receipt. It verifies that the parent or legal guardian made the total payment listed through one of the payment methods and lists any financial aid subsidies. Both the daycare provider and the parent should sign the form to verify that the totals are correct.

Text for Template

[Name of Daycare] Daycare Tax Statement

For the [Insert Year] Tax Year

Provider's Name: _________________________________

Provider's Address: _______________________________

_______________________________________________

SSI# or EIN #: _______________________

Amount Received: $____________________

Form of Payment: [ ] Cash [ ] Check [ ] Money Order [ ] Credit Card

Child Care Subsidy (if applicable): $ ________________________

Total: _________________________

Received from:

Parent/Legal Guardian's Name: ____________________________

For [Child's Name]: __________________________

Parent/Guardians Address: _____________________________

__________________________________________

Parent/Guardian Signature: _____________________ Date: ___________

Provider's Signature: _________________________ Date: ____________

The parent's signature above certifies that the above information is correct to their knowledge. Please return a copy of this form to your daycare provider.

Get 70+ Editable Daycare Templates for Almost Every Situation

We know daycare providers like yourself are busy. That's why we made dozens of templates to help you manage the various aspects of your organization. From billing and invoicing to marketing materials, we have it all. Download all 70 today!

We know daycare providers like yourself are busy. That's why we made dozens of templates to help you manage the various aspects of your organization. From billing and invoicing to marketing materials, we have it all. Download all 70 today!